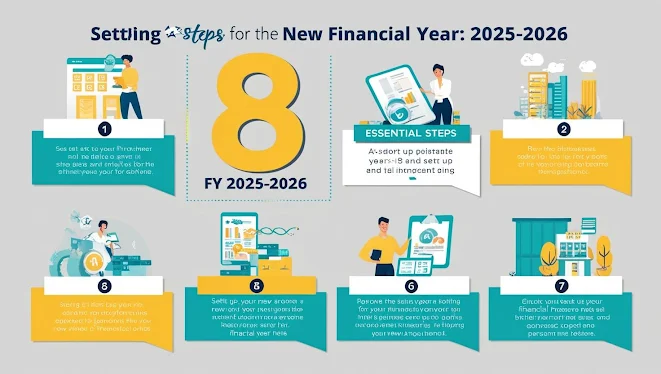

8 Essential Steps to Set Up for the New Financial Year 2025-26

8 Essential Steps to Set Up for the

New Financial Year 2025-26

As April 1st, 2025, marks the beginning of the Financial Year 2025-26 (FY26), businesses must ensure a seamless transition by implementing essential financial, compliance, and operational updates. Here are eight crucial steps to effectively set up for the new financial year:

1. Start a New Invoicing Series for FY26

To maintain clarity and ensure compliance, businesses should establish a new invoicing series beginning April 1, 2025. This helps in:

Differentiating invoices from the previous financial year.

Avoiding duplication and confusion in record-keeping.

Enhancing transparency in audits and tax filings.

👉 Example: If your invoice series was INV/24-25/001, start the new year with INV/25-26/001.

2. Ensure E-Invoicing Compliance (If Applicable)

Businesses with a turnover exceeding ₹5 Crore in FY 2024-25 must implement E-Invoicing from April 1, 2025. Key actions include:

Registering on the Invoice Registration Portal (IRP).

Updating accounting and ERP software to generate e-invoices.

Training teams to ensure smooth compliance.

👉 Non-compliance with e-invoicing rules can lead to penalties and disruptions in business operations.

3. Conduct a Physical Stock Verification & Reconciliation

A thorough physical stock verification as of March 31, 2025, ensures accurate inventory records. Steps include:

Matching physical stock with books of accounts.

Identifying discrepancies and resolving mismatches.

Adjusting for damaged, obsolete, or slow-moving inventory.

👉 Well-reconciled stock data helps in financial accuracy, tax filing, and better inventory management.

4. Reconcile GST Sales Data with GSTR-1

To avoid compliance issues, businesses must:

Cross-check sales data with GSTR-1 filings.

Ensure that all credit notes are passed on to customers.

Verify that there are no mismatches between books and GST returns.

👉 Reconciliation ensures smooth input tax credit claims and reduces the risk of GST notices.

5. Verify Purchases Against GSTR-2B for ITC Claims

Input Tax Credit (ITC) is crucial for reducing tax liabilities. To ensure full ITC claims:

Cross-check purchase records with GSTR-2B.

Ensure that all supplier invoices are uploaded and matched.

Follow up with vendors for any missing invoices.

👉 A mismatch can lead to ITC reversals, increasing tax liabilities.

6. Prepare a Financial Budget & Projections

Strategic financial planning is key for a successful business year. Key steps:

Set revenue targets, expense forecasts, and profit margins.

Analyze past performance to improve financial strategies.

Allocate resources efficiently for growth and expansion.

👉 A well-planned budget helps businesses stay profitable and competitive.

7. Complete Bank Reconciliations & Clear Pending Entries

A thorough bank reconciliation ensures accurate cash flow management. Important checks:

Match bank statements with ledger balances.

Identify uncleared cheques, pending deposits, or discrepancies.

Pass necessary accounting entries to correct errors.

👉 This prevents financial misstatements and improves liquidity management.

8. Update LUT for Exporters & SEZ Suppliers

Businesses engaged in exports or supplying to SEZ units must renew and mention their Letter of Undertaking (LUT) number on all invoices from April 1, 2025. Steps include:

Filing a fresh LUT for FY 2025-26 on the GST portal.

Ensuring that all invoices for zero-rated supplies include the updated LUT number.

👉 Missing LUT details can lead to unnecessary IGST payments on exports.

Final Thoughts

As the new financial year begins, following these eight essential steps will ensure smooth financial operations, regulatory compliance, and better business efficiency. Proper planning and execution will set the foundation for a successful FY 2025-26!

🚀 Need assistance in financial planning, tax compliance, or business strategy? Connect with experts today!

Team Eaztaxbiz

Write us : ca@eaztaxbiz.com

Reach us : +91-9921010284

Comments

Post a Comment